What is the Undeposited Funds Account?

The Undeposited Funds account acts as a temporary holding place for payments received from customers before they are deposited into the bank. This account helps ensure that the financial records in QuickBooks match the actual bank deposits.

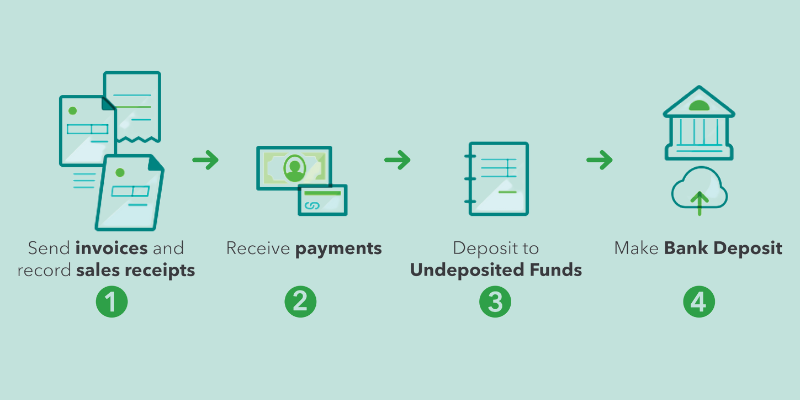

Workflow with Undeposited Funds

- Receipt of Payment: When a business receives a check or confirms a credit card payment from a customer, it records the payment in QuickBooks Online (QBO) as received. The payment is initially placed in the Undeposited Funds account.

- Clearing Customer Account: This action clears the customer’s account for the particular invoice, removing the outstanding balance.

- Deposit to Bank: Instead of depositing each check individually, businesses typically accumulate several payments and deposit them together. For example, multiple $100 checks might be deposited as a single $500 transaction.

- Bank Deposit Entry: When the business deposits these payments at the bank, the bank combines them into a single transaction. The business then records this combined deposit in QBO, moving the funds from the Undeposited Funds account to the bank account.

Example of Accounting Entries

Sale Date (10/01/2023):

Mikey’s Account Dr. $5,000

Michael’s Account Dr. $5,000

To Sales Account $10,000

Result: Accounts Receivable increases by $10,000.

Payment Dates (10/07/2023 & 10/10/2023): For Mikey on 10/07/2023:

Undeposited Funds Account Dr. $5,000

To Mikey’s Account $5,000

For Michael on 10/10/2023:

Undeposited Funds Account Dr. $5,000

To Michael’s Account $5,000

Result: Accounts Receivable decreases to zero, and Undeposited Funds account shows a $10,000 balance.

Bank Deposit Date (10/12/2023):

Bank Account Dr. $10,000

To Undeposited Funds Account $10,000

Result: The Undeposited Funds account balance is zero, and the bank account balance increases by $10,000.

Reconciling Undeposited Funds

- Identify Payments in Undeposited Funds: Navigate to the “Bank Deposit” screen in QBO to see all recorded payments in the Undeposited Funds account.

- Match Bank Feeds: When the bank feed shows a combined deposit, match this with the corresponding payments in the Undeposited Funds. Select the payments that make up the total deposit amount.

- Combine Payments: Select the payments (e.g., $5,000 from Mikey and $5,000 from Michael) to match the $10,000 deposit shown in the bank feed.

- Ensure Zero Balance: The Undeposited Funds account should have a zero balance at the end of the period or contain only recently received payments not older than a week.

Dealing with Old Payments in Undeposited Funds

Common Issues:

- Directly Recorded Income: The deposit might have been recorded directly as income, bypassing the Undeposited Funds account.

- Duplicate Transactions: There might be duplicate entries already cleared against a bank deposit.

Steps to Clear Old Payments:

- Review Transactions: Thoroughly review all transactions in the Undeposited Funds account.

- Match Deposits Correctly: Ensure that all payments are matched with corresponding bank deposits.

- Adjust Entries: If necessary, adjust entries to reflect correct matching, ensuring that no old payments remain unaccounted for.

- Eliminate Duplicates: Remove any duplicate entries to ensure the accuracy of the account.

By following these steps, you can effectively manage and reconcile the Undeposited Funds account, ensuring that your financial records accurately reflect the bank transactions.